Take Control of Your Charitable Giving with a Donor-Advised Fund

Giving Made Simple and Strategic

Establishing a Donor Advised Fund (DAF) with the Foundation offers a personalized and flexible approach to philanthropy. This charitable giving vehicle allows you to support the causes you care about, both locally and nationally, while maximizing tax benefits and simplifying the donation process.

What is a Donor Advised Fund?

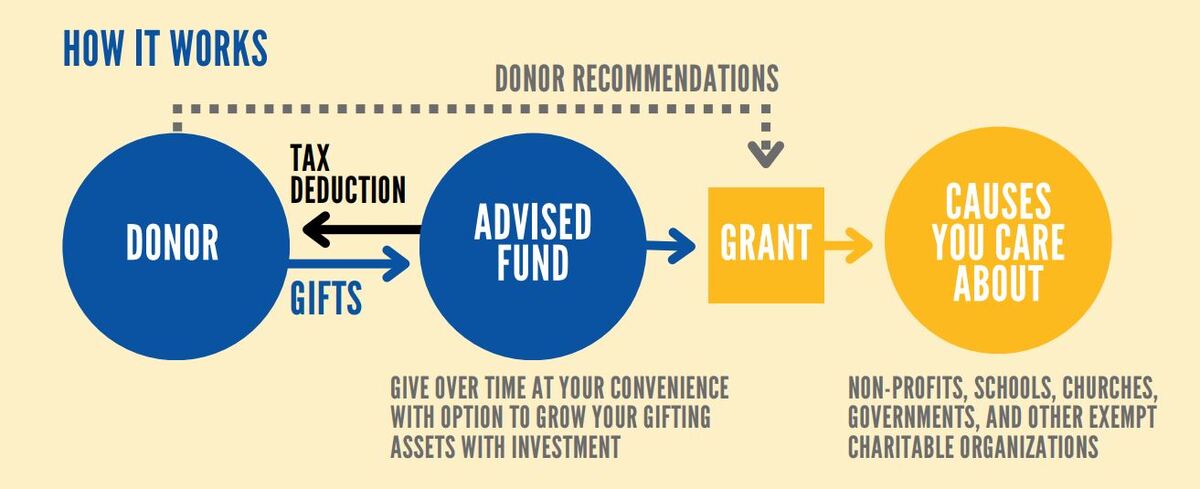

A Donor Advised Fund is a charitable account established under the umbrella of a public charity, such as the Foundation. You make an upfront, irrevocable contribution to the fund—using cash, stocks, or other assets—and receive an immediate tax deduction. You then retain the ability to recommend grants from the fund to any qualified nonprofit, school, church, or government agency at times that align with your philanthropic goals.

Benefits of a Donor Advised Fund

- Personalized Giving: Direct your contributions to the organizations and causes that matter most to you, ensuring your charitable intentions are fulfilled.

- Simplified Tax Deductions: Each contribution to your fund is tax-deductible in the year it's made, streamlining your charitable tax benefits.

- Flexible Timing: With no annual distribution requirements, you can recommend grants when it best suits your charitable objectives, providing flexibility and control.

- Potential for Growth: Your fund can be invested alongside the Foundation's assets, offering the opportunity for your charitable dollars to grow over time.

- Secure Online Access: Monitor your fund balance and make grant recommendations conveniently through our online portal.

How It Works

-

Establish Your Fund: Collaborate with the Community Foundation to create your Donor Advised Fund, tailoring it to reflect your philanthropic interests.

-

Make Contributions: Donate assets such as cash, appreciated securities, or other complex forms of giving to your fund, receiving immediate tax benefits.

-

Recommend Grants: At your convenience, suggest grants from your fund to support qualified charitable organizations of your choice.

Frequent Use Cases

- Simplify Your Giving – Manage all your charitable donations in one place, making tax deductions easier and automating contributions as needed.

- Tax Benefits – Utilize tax-efficient giving strategies like bundling multiple years of donations into a single tax year or donating appreciated assets such as stocks to maximize your impact.

- Alternative to a Private Foundation – A Donor Advised Fund provides a similar structure to a private foundation with fewer startup costs, more flexibility, and the option to give anonymously if desired.

Why Partner with the Community Foundation?

Since 1951, the Hamilton Community Foundation and our affiliates in Ross and Fairfield have been a trusted steward of charitable assets, committed to enhancing the quality of life in our communities. Our experienced staff offers personalized service, deep community knowledge, and a commitment to aligning your charitable and financial goals. By establishing a Donor Advised Fund with us, you join a legacy of donors dedicated to making a lasting impact.

Ready to Create Your Own Donor Advised Fund?

Connect with our Donor Services Team today to learn how you can establish a fund that makes a lasting impact.